Winston

Lorenzo von Matterhorn

- Joined

- Jan 31, 2009

- Messages

- 9,560

- Reaction score

- 1,748

Well, the can-kicking to forstall the inevitable that has allowed the Greece situation to be kicked down the road for the past five years has finally hit a huge speed bump today. In those past five years, the PRIVATE banks and bond holders who knowingly loaned huge sums to the known bad credit risk called "Greece" because of the high returns they'd get, nearly identical to the reason behind our 2008 sub-prime debt problem and crash, have managed to dump that debt now that it's gone sour onto the backs of EU taxpayers, knowing they'd be able to get away with that from day one just as it was allowed here in 2008 and since then.

Now, unless the ECB can come up with more monetary shell games to kick the can down the road yet again, other countries whose economies are in bad shape, like Spain, Italy, and France will be among those countries liable for any Greek debt not paid, an additional burden which will only make their situations worse. The very few economic analysts in the mainstream media with IQs over 60 have realized that the game theory expert in the Greek government has knowingly and cleverly played on that fact with a delaying game to intentionally make the outstanding Greek debt even larger (with 90% of all of that debt-increasing debt "aid" going simply to pay Greece's creditors and NOT the Greek people) and therefore more systemically dangerous to the EU economy, thereby greatly increasing the likelihood of some debt forgiveness. Applicable quote: "If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem." - J. Paul Getty

Trouble is, if Greece gets some debt forgiveness, all of the other countries with too much debt in the EU are going to want it, too, and will probably put the decision to refuse to go along with repayment agreements to a public referendum just as the Greeks just did. And so the EU/Euro dominoes may begin to fall. The ECB and, especially, Germany has known this all along, playing like they held all of the cards when, in fact, they didn't and most definitely do not. Back to that J. Paul Getty quote which too many in the mostly brain-dead mainstream financial media seemed to conveniently forget (those being the same idiots who were screaming "buy, buy, buy" right up to the 2008 crash).

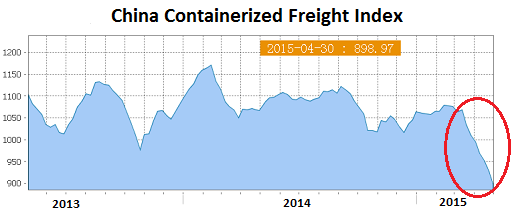

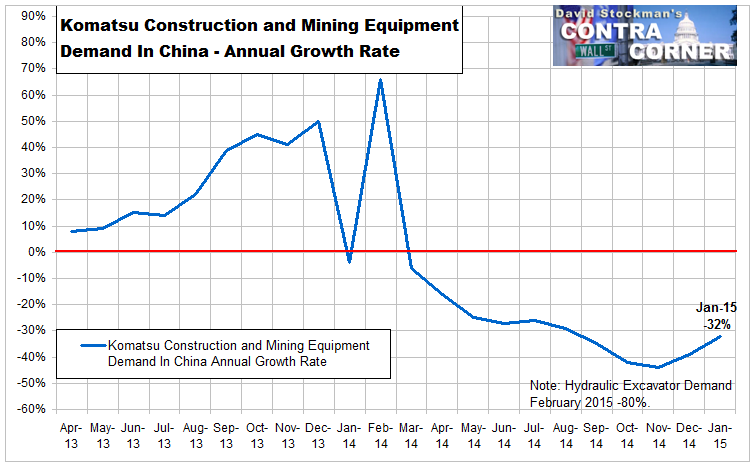

Meanwhile, the Chinese are probably in the midst of an economic hard landing with a HUGE real estate bubble that's popping, a major internal debt problem, a stock market that's crashing 5-6% PER DAY, and a major export drop that'll only get worse when the EU's economy, then the world's, sinks even further. The China that helped dig the world out of the last bubble crash won't be there this time.

The other BRIC countries which also greatly helped the world to climb out from the depths of the last crash are also not doing at all well.

Additionally, nearly every central bank in the world has used up their recession fighting "ammo" in order to produce this artificial, unsustainable, economic "recovery" made possible only by the BORROWING of more trillions of dollars worldwide. They have few tools left for fighting the next crash from the new, even bigger bubble they've thus created.

The Fed has held interest rates at zero for an unprecedented seven years and the US economy is still at stall speed. Why? One reason is that we have reached debt saturation where there is little or no multiplicative effect from each additional dollar of debt accrued. In other words, whereas one dollar of new debt would have at one time generated, say, $1.50 worth of new economic activity, a current dollar of additional debt produces little or no additional economic activity beyond that dollar spent. That's the inevitable result of the law of exponents when corrective recessions are, via central bank monetary manipulation, not allowed to naturally run their course and through the resulting, absolutely essential Darwinian effect of bankruptcies wiping debt off the books to reset the debt growth curve to a more acceptable slope.

All it takes now is some unknown trigger event to get the whole set of dominoes falling as Lehman Brothers did in 2008. And since the trigger event doesn't have to be large (unstable systems don't take much to disrupt), Greece might be it.

Or not.

If I knew, I'd already be insanely rich.

Anyway, it might be a very interesting week in the equity markets (DJIA, S&P, etc.).

BTW, you can credit (har!) this mess to a near-religious adherence to a GARBAGE economic theory, the garbage models based upon it, and the garbage data fed into them (the economic data manipulated for political reasons) despite the same theory and models being proven time and again to be unable to even see let alone predict economic bubbles.

So, why the adherence to it? Because it tells both banks and governments what they WANT to hear - that you can PRINT and BORROW your way to prosperity. BTW, it doesn't matter what major political party is in power. This is NOT a partisan issue. They all hire and rehire the same clueless ivory tower types who caused the last crisis, the serial bubble/bust creators. And like both Greenspan and Bernanke, they always manage to retire just in the nick of time.

A short video on the garbage theory and its models being used to run the world:

[video=youtube;jIP7ES1lCGk]https://www.youtube.com/watch?v=jIP7ES1lCGk[/video]

and

[video=youtube;bjstqoRz6IE]https://www.youtube.com/watch?v=bjstqoRz6IE[/video]

Now, unless the ECB can come up with more monetary shell games to kick the can down the road yet again, other countries whose economies are in bad shape, like Spain, Italy, and France will be among those countries liable for any Greek debt not paid, an additional burden which will only make their situations worse. The very few economic analysts in the mainstream media with IQs over 60 have realized that the game theory expert in the Greek government has knowingly and cleverly played on that fact with a delaying game to intentionally make the outstanding Greek debt even larger (with 90% of all of that debt-increasing debt "aid" going simply to pay Greece's creditors and NOT the Greek people) and therefore more systemically dangerous to the EU economy, thereby greatly increasing the likelihood of some debt forgiveness. Applicable quote: "If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem." - J. Paul Getty

Trouble is, if Greece gets some debt forgiveness, all of the other countries with too much debt in the EU are going to want it, too, and will probably put the decision to refuse to go along with repayment agreements to a public referendum just as the Greeks just did. And so the EU/Euro dominoes may begin to fall. The ECB and, especially, Germany has known this all along, playing like they held all of the cards when, in fact, they didn't and most definitely do not. Back to that J. Paul Getty quote which too many in the mostly brain-dead mainstream financial media seemed to conveniently forget (those being the same idiots who were screaming "buy, buy, buy" right up to the 2008 crash).

Meanwhile, the Chinese are probably in the midst of an economic hard landing with a HUGE real estate bubble that's popping, a major internal debt problem, a stock market that's crashing 5-6% PER DAY, and a major export drop that'll only get worse when the EU's economy, then the world's, sinks even further. The China that helped dig the world out of the last bubble crash won't be there this time.

The other BRIC countries which also greatly helped the world to climb out from the depths of the last crash are also not doing at all well.

Additionally, nearly every central bank in the world has used up their recession fighting "ammo" in order to produce this artificial, unsustainable, economic "recovery" made possible only by the BORROWING of more trillions of dollars worldwide. They have few tools left for fighting the next crash from the new, even bigger bubble they've thus created.

The Fed has held interest rates at zero for an unprecedented seven years and the US economy is still at stall speed. Why? One reason is that we have reached debt saturation where there is little or no multiplicative effect from each additional dollar of debt accrued. In other words, whereas one dollar of new debt would have at one time generated, say, $1.50 worth of new economic activity, a current dollar of additional debt produces little or no additional economic activity beyond that dollar spent. That's the inevitable result of the law of exponents when corrective recessions are, via central bank monetary manipulation, not allowed to naturally run their course and through the resulting, absolutely essential Darwinian effect of bankruptcies wiping debt off the books to reset the debt growth curve to a more acceptable slope.

All it takes now is some unknown trigger event to get the whole set of dominoes falling as Lehman Brothers did in 2008. And since the trigger event doesn't have to be large (unstable systems don't take much to disrupt), Greece might be it.

Or not.

If I knew, I'd already be insanely rich.

Anyway, it might be a very interesting week in the equity markets (DJIA, S&P, etc.).

BTW, you can credit (har!) this mess to a near-religious adherence to a GARBAGE economic theory, the garbage models based upon it, and the garbage data fed into them (the economic data manipulated for political reasons) despite the same theory and models being proven time and again to be unable to even see let alone predict economic bubbles.

So, why the adherence to it? Because it tells both banks and governments what they WANT to hear - that you can PRINT and BORROW your way to prosperity. BTW, it doesn't matter what major political party is in power. This is NOT a partisan issue. They all hire and rehire the same clueless ivory tower types who caused the last crisis, the serial bubble/bust creators. And like both Greenspan and Bernanke, they always manage to retire just in the nick of time.

A short video on the garbage theory and its models being used to run the world:

[video=youtube;jIP7ES1lCGk]https://www.youtube.com/watch?v=jIP7ES1lCGk[/video]

and

[video=youtube;bjstqoRz6IE]https://www.youtube.com/watch?v=bjstqoRz6IE[/video]